“You’re only a YIMBY because you rent.” I’ve heard that for years, so when I bought a condo in late 2022, I wanted to do something to ensure I’d continue supporting new housing. After all, studies show that the law of supply and demand applies to housing: New construction slows rent growth (opens in new tab), sometimes reduces rents, and leads people to move into better units.

I believe that San Francisco should again become an affordable, welcoming city for free thinkers, progressives, entrepreneurs, and people who don’t feel at home elsewhere. Yet it’s become harder for everyone but the wealthy to move to San Francisco and stay here as they start families.

Here’s how I’m trying to help: I’ve pledged to donate the difference in what I’d pay in property taxes under a fair system to charity.

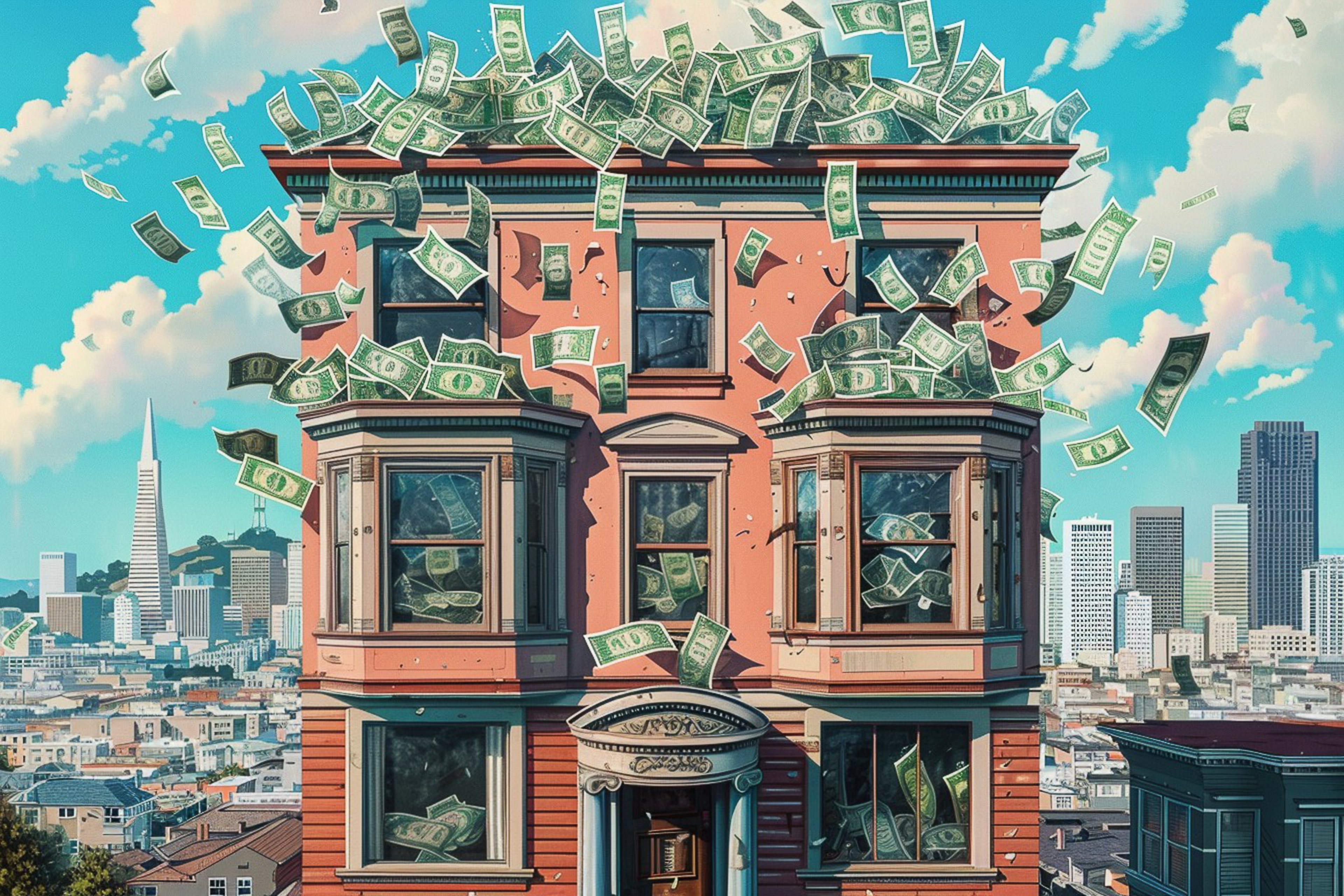

You see, homeowner equity is not the most egregious part of our housing problem. Instead, it’s how San Francisco, California and U.S. tax codes and public policy intersect to distribute that wealth to entrench the already rich and make it harder for everyone else.

Voters passed Proposition 13 in 1978 as part of a broader tax revolt. It capped state property taxes at 1% of a property’s assessed value and assessed value growth at 2% per year or inflation, whichever is lower, regardless of how much the property grows in value. This led to the average San Francisco homeowner paying $10,000 less (opens in new tab) per year in property taxes than they would if we repealed the measure and assessed value more closely according to a property’s real value, as in most states. The California Legislative Analyst’s Office found that (opens in new tab) Prop. 13 has led to fewer people under 35 owning homes. As cities have scrambled to make up the property tax shortfall, they’ve levied much higher fees on new developments, causing fewer homes to be built.

Since Prop. 13’s passage, San Francisco property values have quintupled, insidiously harming our politics and pitting us against one another. Marginalized communities have watched as they’ve been disproportionately excluded from gaining homeowner wealth. With market-rate housing slipping out of reach for most, some have given up on the concept of supply and demand when it comes to housing, advocating for only a small number of subsidized housing units.

Our city needs to get back into a mindset of abundance and growth, and Prop. 13 has harmed our ability to do so. Since my objection to the measure is its inequity in favoring existing homeowners over new ones, I asked myself how I could economically align my incentives as a homeowner. The answer was simple: Donate my Prop. 13 tax break. I’ve committed to donating 1% of the difference between Zillow’s estimated value of my home and its official appraised value, according to the city every year.

I’ll still benefit from rising property values while sharing that benefit with a charity. I’ve committed to donating between $1,000 and $10,000 annually for at least 10 years.

So, say I’d bought my condo for $1 million and it appreciated to an estimated $1.5 million in a year. Under current tax laws, I would still only owe approximately $10,200 in property taxes: 1% of $1.02M in appraised value.

But with my pledge, I’d donate $4,800 to charity, bringing my tax rate back to 1% of the condo’s current value. So far, my home’s value has remained flat, but I’ve still donated a token $1,000 (opens in new tab) annually for the last two years.

I met Sonja Trauss and Laura Foote, the founders of YIMBY Action, shortly after moving to the city in 2017. The YIMBY movement has shaped my values and helped grow San Francisco. I’ve chosen to give my Prop. 13 tax windfall to YIMBY Law (opens in new tab), Trauss’ nonprofit working to end the housing shortage. The pro-housing watchdog group has forced Bay Area suburbs to follow state housing law and encouraged them to zone for and build more homes.

The concept works regardless of your chosen charity; it doesn’t have to be a housing nonprofit. I encourage other San Francisco homeowners who are concerned about our high housing costs to join me in donating their Prop. 13 tax benefit and advocating for its reform. And this November, don’t forget to vote.

Barak Gila is a recovering software engineer, the founder of American Politics Company, and a leader with SF YIMBY, a nonprofit advocacy group for abundant, affordable housing in the San Francisco Bay Area. Contact him at https://calllist.app/barak (opens in new tab).