Year-end figures show venture capital funding dropped precipitously over the course of 2022, according to a new report from PitchBook (opens in new tab) and the National Venture Capital Association (opens in new tab).

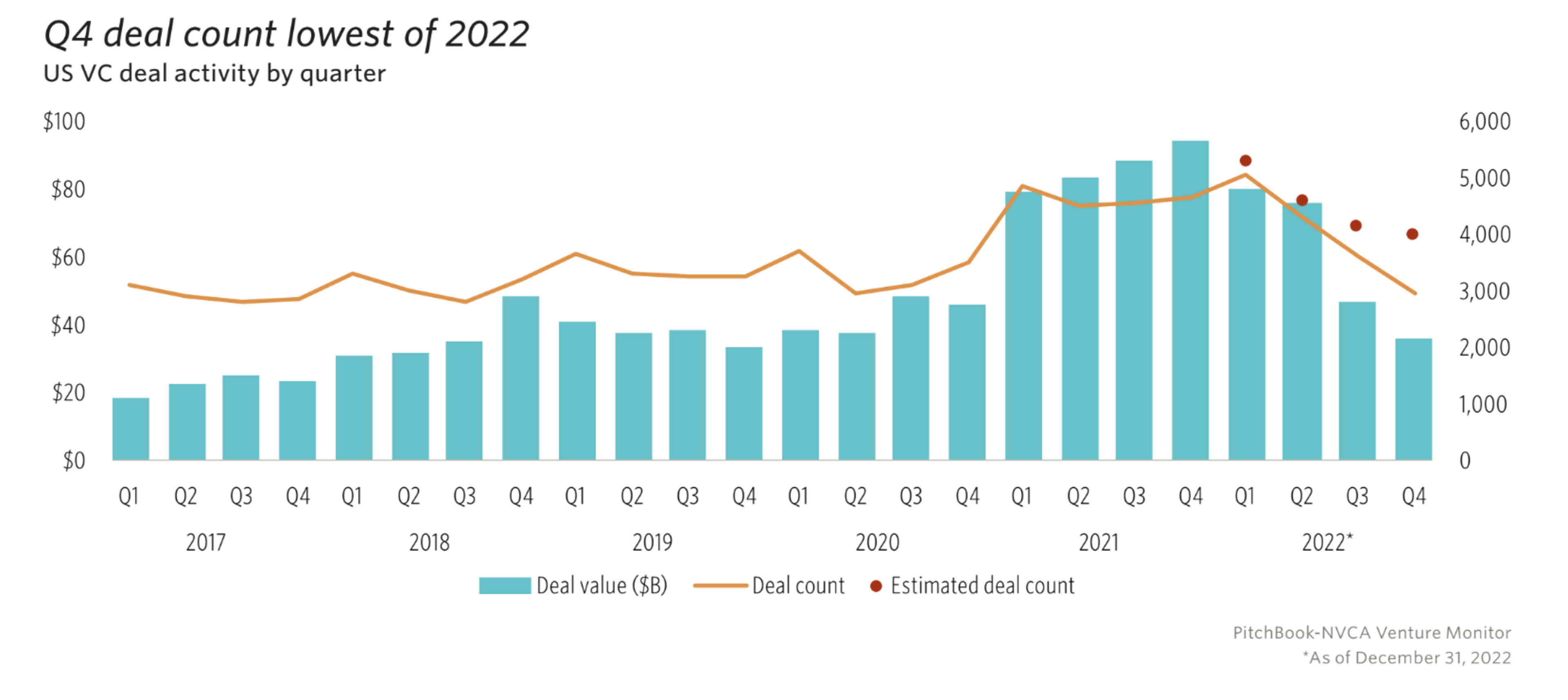

Only $10.7 billion was invested in 1,330 U.S. startups during the fourth quarter of 2022, a big drop from the $26.2 billion during the first quarter.

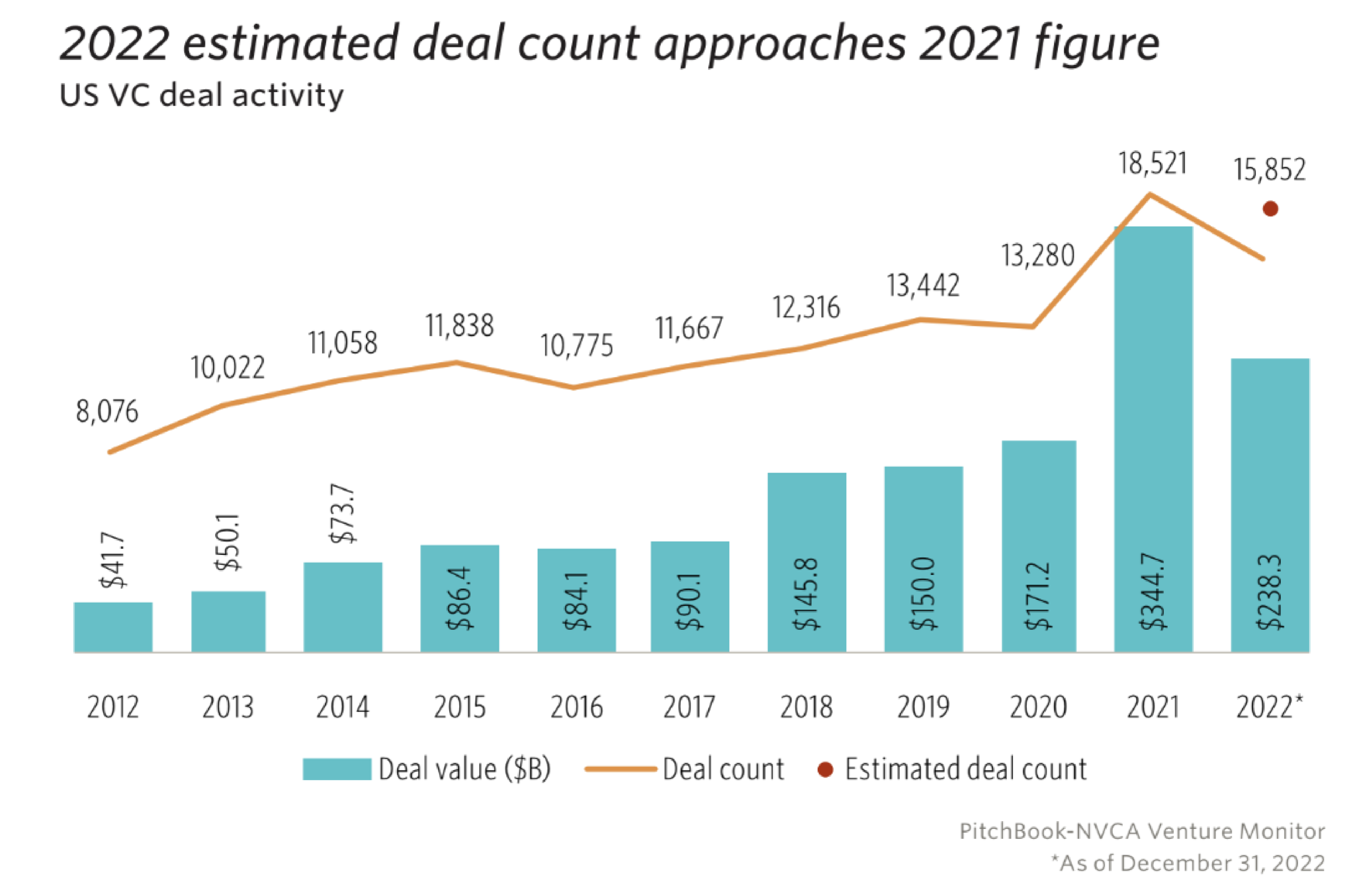

For the year, venture investments hit $238.3 billion, a big decline from the $384.7 billion startups received in 2021—although a considerably larger amount than from any year prior.

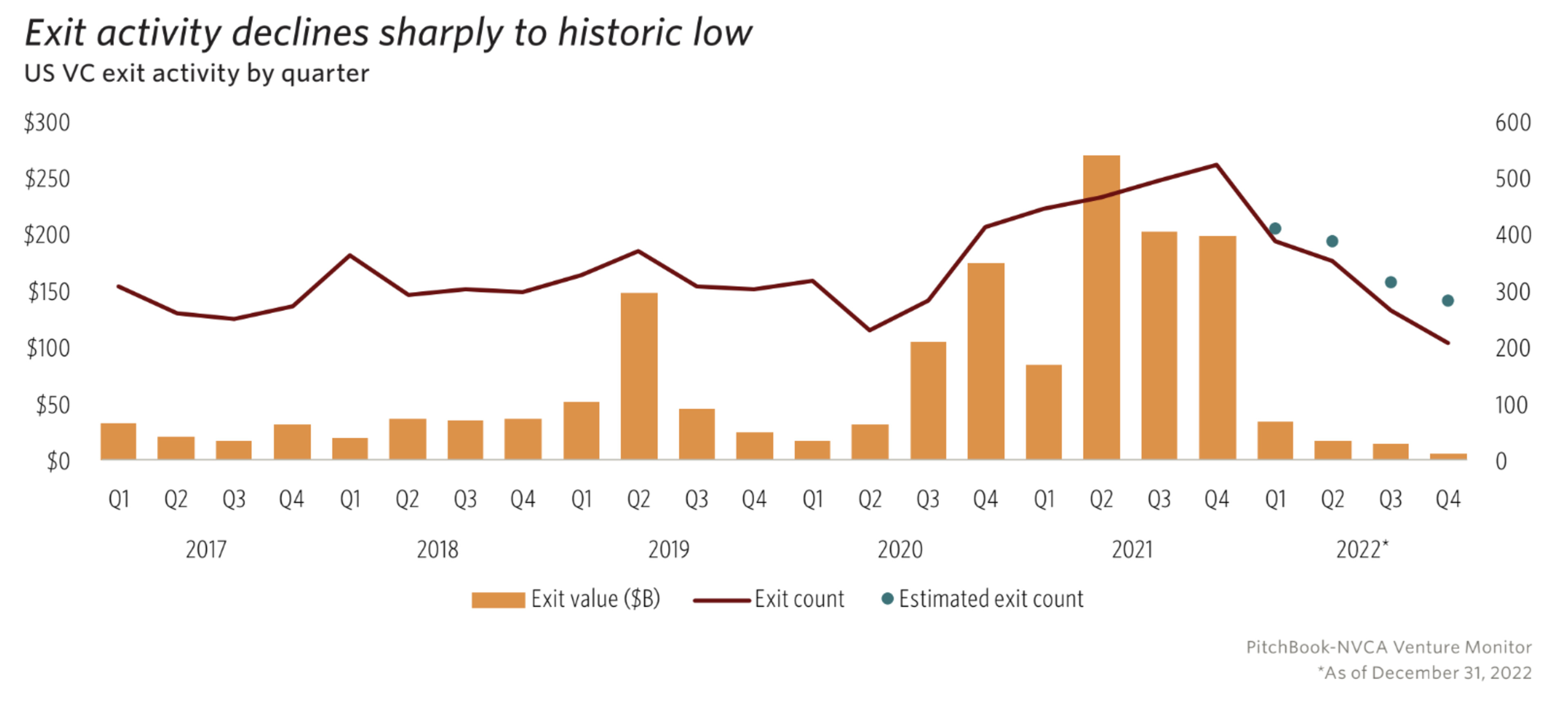

One huge problem scaring VCs: the lack of liquidity opportunities for startup investments. The economic downturn has kept 2022’s value of startup exits—typically acquisitions or initial public offerings (IPOs)—to $71.2 billion, the lowest figure since 2016 and a 90% drop from 2021’s $753.2 billion.

During the fourth quarter, PitchBook tracked only $5.2 billion worth of startup exits, the lowest figure in a decade. The report’s authors speculate that the quarter-over-quarter declines in VC investment and startup exits during 2022 may point to further declines in 2023.

Last year, VC funding directed to San Francisco startups dove along with the market. As of November, monthly venture investments in SF companies dropped from $4.9 billion in January to $1.1 billion in November, totaling $31.5 billion to 1,461 startups.

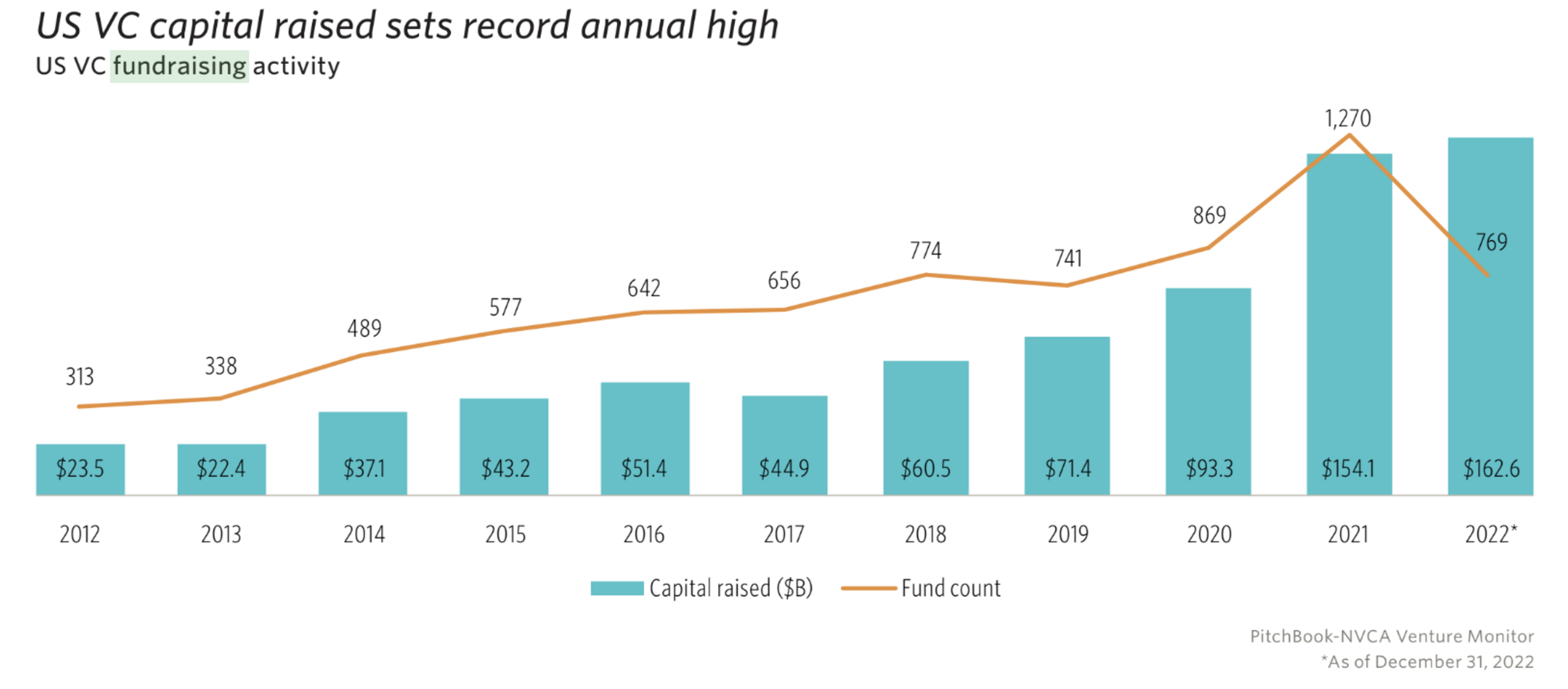

The good news? Strong momentum from 2021’s post-pandemic investment frenzy helped venture capitalists raise a record $162.8 billion across 769 funds during 2022.

Over the next few years, those billions will launch and grow thousands of new startups in the SF Bay Area and around the country.