A Wall Street Journal opinion piece appears to place the blame for the collapse of Silicon Valley Bank squarely at the door of so-called “woke” hiring practices.

Opinion columnist Andy Kessler’s article drew the eyes of Fox News and other right-wing pundits that appear to have taken a line of his article—“I’m not saying 12 white men would have avoided this mess, but the company may have been distracted by diversity demands”—and decided to run with it.

But venture capitalists, tech founders, workers and droves of others on Twitter have hit back at what they say are ludicrous claims that wokeness killed Silicon Valley Bank (SVB).

Outspoken Palo Alto data analyst, Armand Domalewski, posted a screenshot of several white male board members at SVB and sarcastically quipped, “The problem with Silicon Valley Bank was that it was too concerned about DEI for women and people of color.”

The problem with Silicon Valley Bank was that it was too concerned about DEI for women and people of color pic.twitter.com/t806PER8rr

— Armand Domalewski (@ArmandDoma) March 13, 2023

And Jessica Lessin, the founder of tech publication The Information, came out swinging in response to the op-ed, tweeting, “For @wsj to say flat out that SVB could have failed because they added non-white men to their board shows how far behind the times (and certifiably stupid) this publication really is.”

For @wsj to say flat out that SVB could have failed because they added non-white men to their board shows how far behind the times (and certifiably stupid) this publication really is. It makes me so angry and very sad. WSJ readers and staff deserve better. pic.twitter.com/ppbcugJNhW

— Jessica Lessin (@Jessicalessin) March 13, 2023

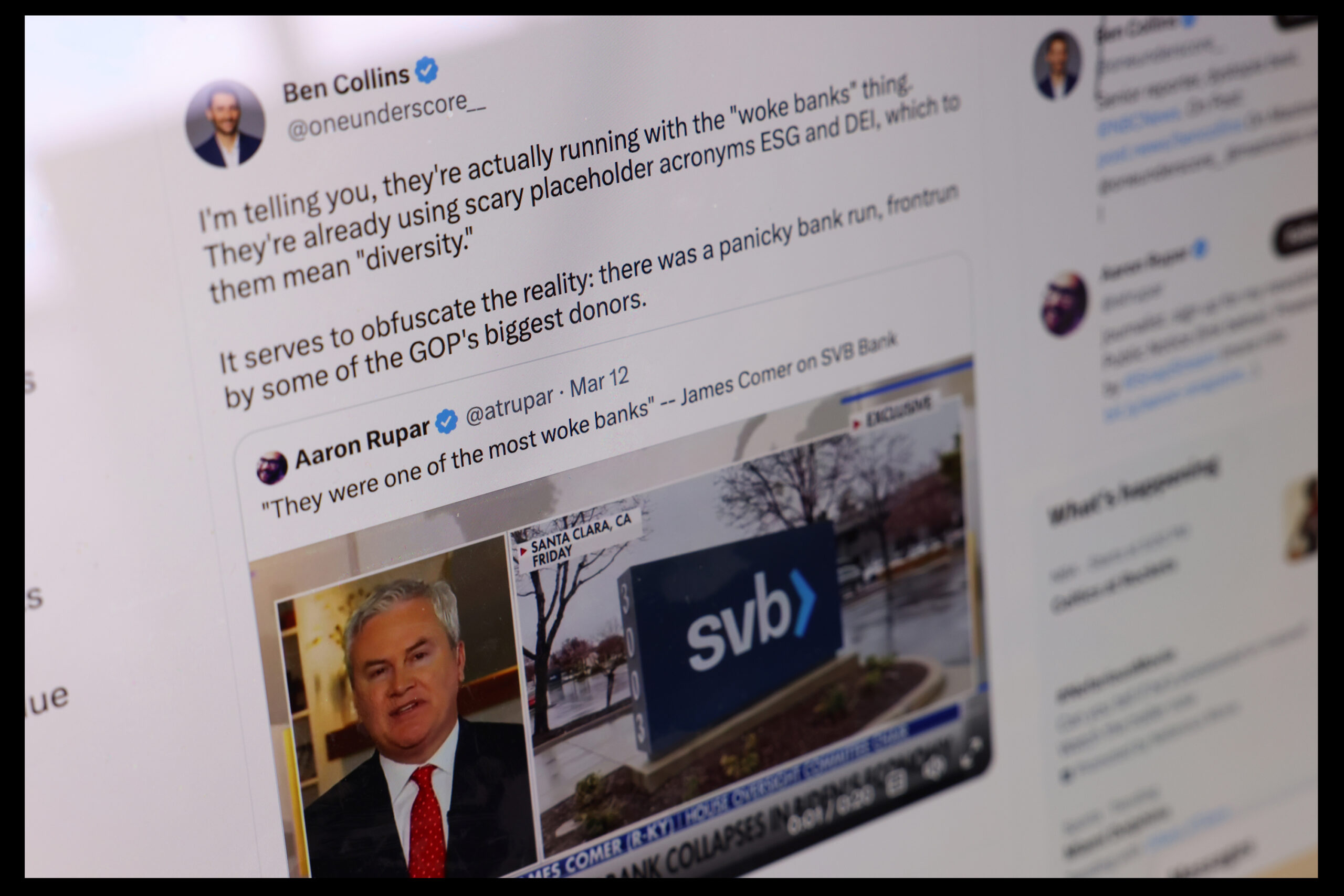

And NBC’s Ben Collins tweeted: “They’re actually running with the ‘woke banks’ thing.”

I'm telling you, they're actually running with the "woke banks" thing. They're already using scary placeholder acronyms ESG and DEI, which to them mean "diversity."

— follow @bencollins on bluesky (@oneunderscore__) March 12, 2023

It serves to obfuscate the reality: there was a panicky bank run, frontrun by some of the GOP's biggest donors. https://t.co/Rrhxj6rTOs

Domalewski followed up in an apparent state of disbelief while retweeting a Fox News take on the SVB wokeness debate in the below tweet:

I am genuinely amazed that “tech company bank went under because it cared too much about Black people and women” is the line they are going with.

— Armand Domalewski (@ArmandDoma) March 13, 2023

Like…wow. https://t.co/W7nX5JWgz0

Some Republican lawmakers are taking the “woke” angle to a logical conclusion: “woke bailouts,” with Missouri Sen. Josh Hawley pledging to introduce legislation to prevent his constituents from paying into FDIC efforts to make customers whole (the FDIC is actually using money from fees paid by banks to the agency).

Now we learn the Biden Admin will impose “special assessments” (= fees) on banks across the country to pay for the SVB bailout. No way MO customers are paying for a woke bailout. I will introduce legislation preventing any bank from passing these fees on to customers –

— Josh Hawley (@HawleyMO) March 13, 2023

And Republican U.S. Rep. Andy Biggs tweeted that the bank’s resources “should have not been blown on woke/DEI initiatives instead of actual financial management.”

No bailouts for SVB (Silicon Valley Bank).

— Rep Andy Biggs (@RepAndyBiggsAZ) March 13, 2023

Its resources should have not been blown on woke/DEI initiatives instead of actual financial management.

It also doesn’t help that Biden’s excessive spending is creating interest rate chaos.

He cannot allow more banks to fail.

Meanwhile, Quartz technology reporter Scott Nover quipped, “At Woke Bank, you can’t cash your check until you check your privilege.”

At Woke Bank, you can’t cash your check until you check your privilege

— Scott Nover (@ScottNover) March 13, 2023

What Happened to Silicon Valley Bank?

The Santa Clara-based bank, a major backer of technology companies and startups, was abruptly shut down Friday morning, when customers were frozen out of accounts and left scrambling to figure out how to pay employees and keep their businesses running, sources doing business with the bank told The Standard.

The second biggest bank to fail in U.S. history, and the biggest bank failure since the 2008 financial crisis, saw the Federal Deposit Insurance Corporation send a Saturday note to bank employees offering them 45 days of work to protect depositors. The employees will get a pay bump to help in the transition as Silicon Valley Bank sells off assets.

The federal government announced that all of Silicon Valley Bank’s clients would have access to their money starting Monday morning. U.S. Treasury Secretary Janet Yellen said on Sunday that the government would not bail out the bank, instead focusing its efforts on concerned depositors.

An SVB shareholder has since filed a federal lawsuit against the failed institution, alleging the company was negligent in its management and oversight.