A $20 billion Adobe deal to buy San Francisco design software company Figma has rocked the local tech industry after a year largely defined by rising interest rates, market volatility and mass layoffs.

And the purchase ranks among the largest-ever acquisitions of a private venture-backed tech company in the U.S., according to Pitchbook.

The deal comes with a major windfall for Figma’s 30-year-old co-founder and CEO Dylan Field, who dropped out of college a decade ago with an idea that would become a multibillion-dollar company. Field’s roughly 10% stake in Figma is now worth some $2 billion.

Field was raised in Sonoma County and his parents told the Santa Rosa Press Democrat (opens in new tab) that he was a math whiz, solving algebra problems at the age of 6. He later attended a STEM magnet school (opens in new tab) where he took college courses with Sonoma State students before heading to Brown University.

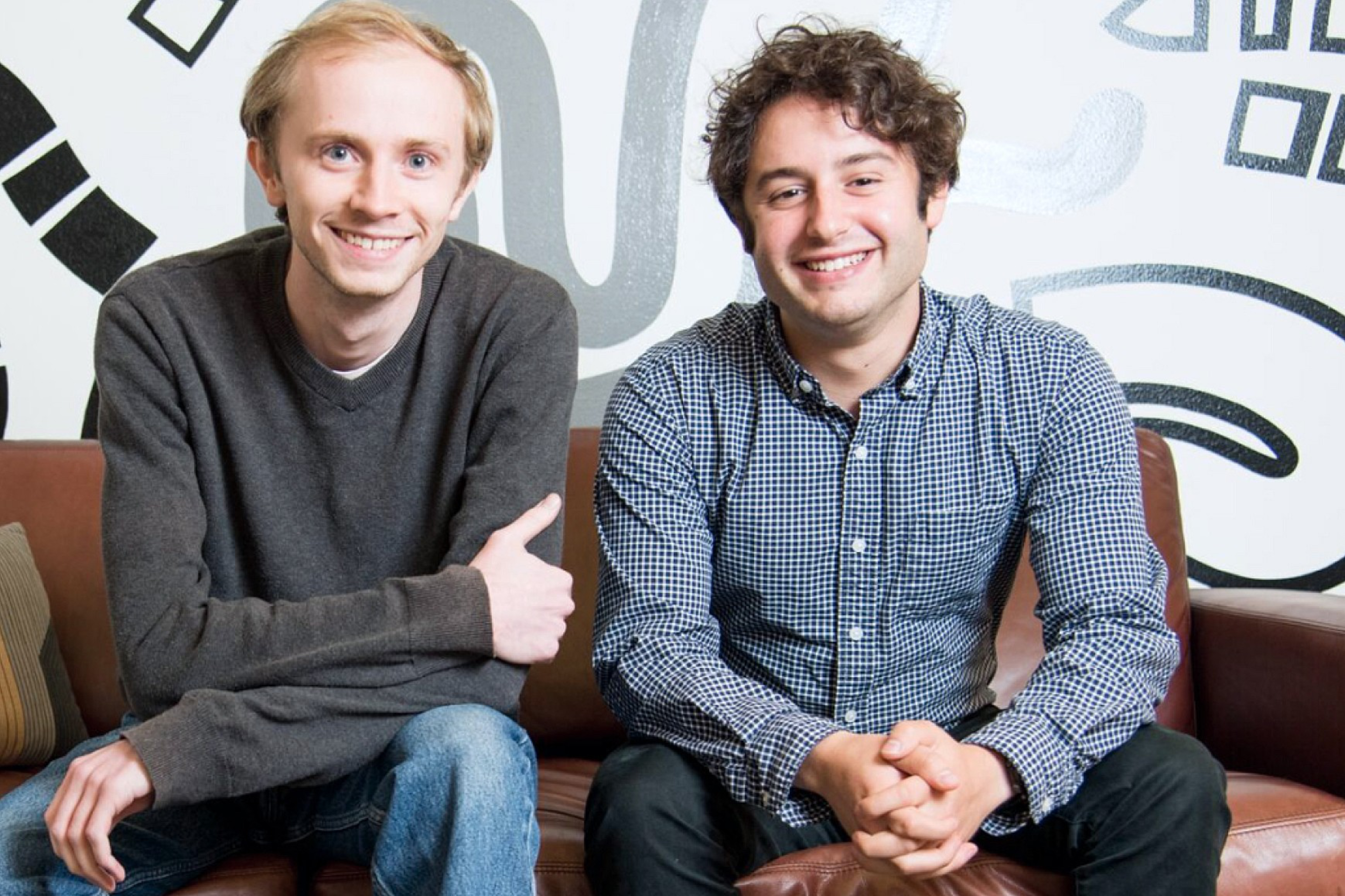

In college, Field worked as an intern at Flipboard and Linkedin and was spotted (opens in new tab) as an early talent before starting Figma with computer science classmate Evan Wallace. Against the objections of his parents, Field dropped out of school at age 20 to take part in the Thiel fellowship program, which came with a $100,000 grant from PayPal co-founder Peter Thiel.

A 2012 videotaped pitch for his company (opens in new tab) shows a 19-year-old Field demonstrating his early ambitions to take on Adobe’s dominance of design software.

“Training yourself to use Photoshop is a long, arduous process,” he said. “What we’re trying to do is make it so anyone can be creative by making free, simple creative tools in the browser.”

Figma’s platform was first released in 2016 after years of development and functions as web-based graphics and design software that allows for multiple users to work together on a project at the same time. Usage of the company’s product jumped during the pandemic as teams sought new ways to collaborate virtually.

Figma’s flexible feature set and freemium pricing model allowed it to steadily grab market share from Adobe, the long-time leader in design and graphics software. According to market research firm Slintel (opens in new tab), Figma has a market share of around 31% in the collaborative design and prototyping category, more than double that of competitor Adobe XD.

Figma’s purchase price is double the $10 billion valuation the startup earned in its 2021 Series E funding round and 10 times the $2 billion valuation it received in 2020. The cash-and-stock deal works out to roughly $40.20 per share of the company. That’s a more than 90 times multiple from the company’s $0.44 seed round shares.

The deal is expected to close in 2023 and as part of it, approximately 6 million additional restricted stock units will be granted to Figma’s CEO and its roughly 850 employees. Those stocks will vest over four years after the close of the deal.

Field will continue to run Figma when the deal closes and will report to David Wadhwani, president of Adobe’s Digital Media business, according to Adobe (opens in new tab).

Outside of the gobbling up of a burgeoning industry rival, Adobe’s offer represents a major bet on Figma’s growth potential. Adobe reported that Figma is on track for around $400 million in annual recurring revenue, with the purchase price representing a 50 times multiple over that revenue number. According to Adobe, the purchase is not expected to be positive for the company’s profits until year three.

There’s still an open question about whether the deal represents a turning point in the fortunes of the industry, with many analysts urging caution.

“This is still one company, and the broader market pressures weighing on venture are still there,” said Kyle Stanford, a senior VC analyst at PitchBook.

But that one deal still means a lot of return for some of the company’s early backers. A rundown of Figma’s investors (opens in new tab) from tech news site The Information demonstrated that windfall. Among the biggest winners are major VC firms like Index Ventures, Greylock Partners and Kleiner Perkins, all of whom have a more than 10% stake in the company (valued at around $2 billion).

One of the other major individual beneficiaries is Jeff Weiner, the executive chairman of Linkedin, who owns a 2.2% stake in the company (valued at around $440 million).

John Lilly, who helped lead Greylock’s investment in Figma and is a company board member, penned a blog post (opens in new tab) after the acquisition announcement, laying out some of the early skepticism of the company, including whether it would even be possible to build a web browser-based design program or if anyone would actually use it.

“It wasn’t obvious that they could build a company to deliver their vision around the world even if they could build a compelling technology and product,” he wrote. “Well, it’s obvious now.”