Editor’s Note: Every month, The Standard’s ‘State of the City’ dashboard analyzes the outlook for San Francisco by monitoring data on the city’s economy, health, crime, housing and other key performance indicators.

After a summer of shifting economic headwinds, an autumn of high-profile tech layoffs, and months of weak earnings and waning venture capital investments, many are worried that the United States is heading towards a recession—and San Francisco’s position at the heart of the tech industry puts it right in the eye of the storm.

In particular, the stock market’s latest declines have experts—including former Treasury Secretary Larry Summers (opens in new tab)—pointing out the chilling similarities between today’s market and the dot-com bubble (opens in new tab).

But is the comparison warranted?

The tech industry grew massively during the pandemic, as headcounts ballooned and company valuations skyrocketed. But now that the Covid expansions have slowed, some of the most stable tech corporations are tumbling, sucking up crucial investor dollars, causing mass layoffs and tanking the stock market in the process. FAANG (Facebook, Apple, Amazon, Netflix and Google) stocks have lost trillions of dollars in market value over the past year, with Meta—Facebook’s parent company—reporting a 75% collapse (opens in new tab) since September 2021.

Deja Vu in San Francisco

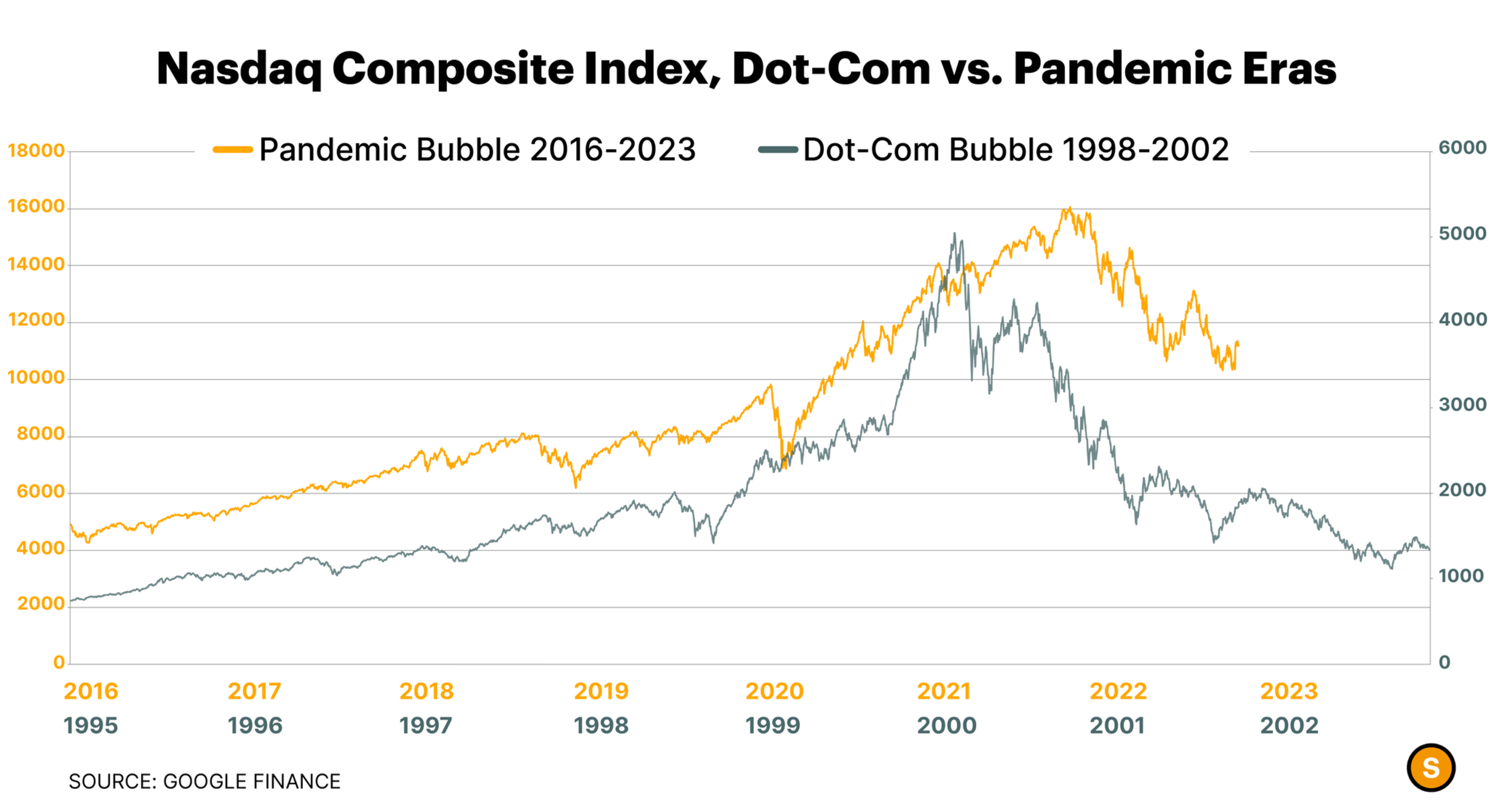

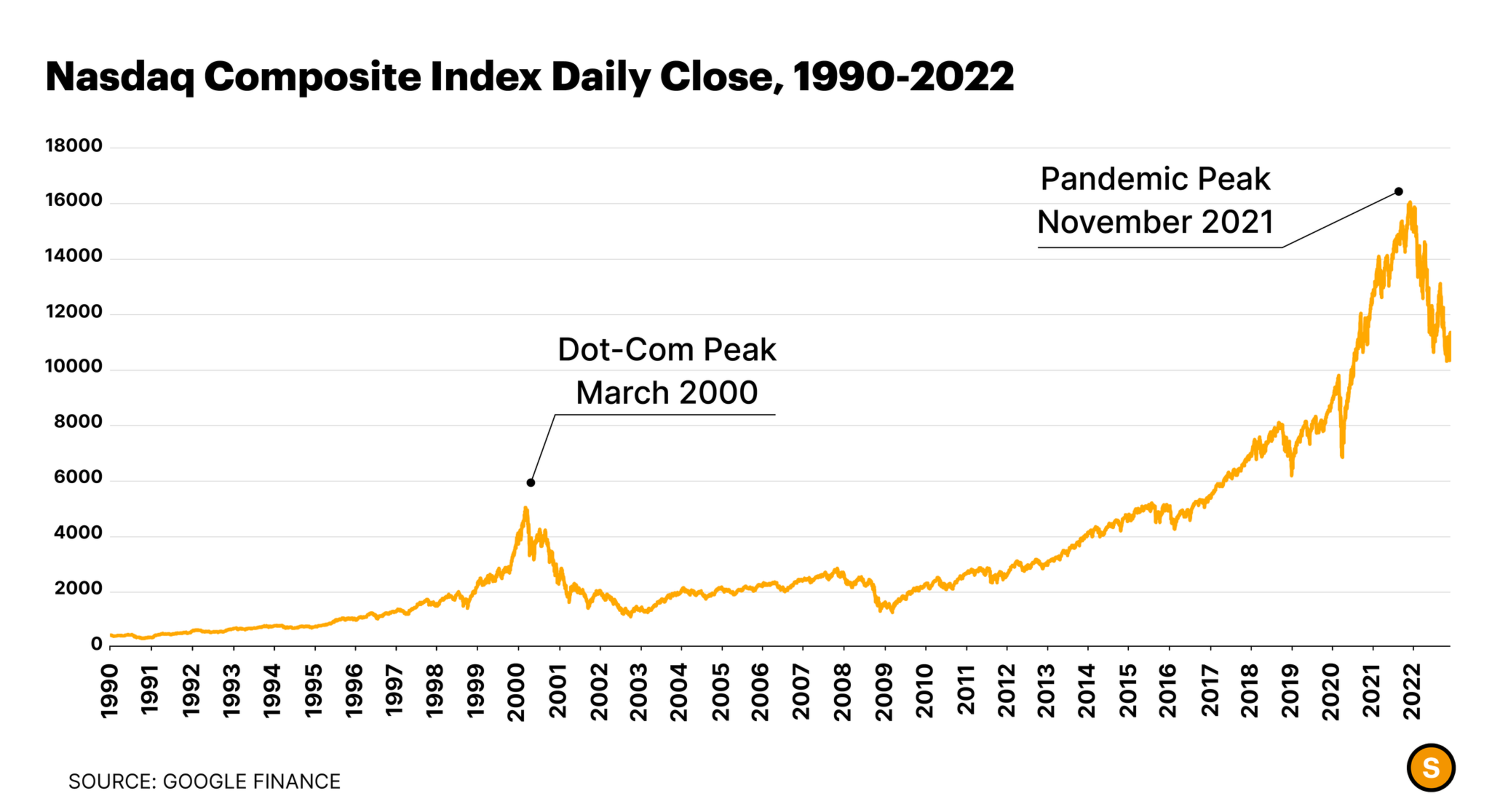

Today’s tech stock performance bears a striking resemblance to the boom-and-bust cycle the SF Bay Area stomached during the dot-com bubble era 20 years ago. From January 2019 to November 2021, the tech-heavy Nasdaq index rose 144% and peaked at 16,057—before tumbling 30% in the following year (opens in new tab).

The dot-com bubble witnessed a very similar rise and fall (opens in new tab): Nasdaq shot up 500% between January 1995 and March 2000, before tanking by 76% across the next two years, effectively canceling out the gains of early internet economy players—and upending San Francisco’s economy, as well.

During the dot-com days, the same economic forces were at work: interest rates were low, venture capital investments were high, and the internet’s earliest companies relished in millions of dollars of investment money that they spent on lavish parties (opens in new tab), $1,000 office chairs (opens in new tab), team lunches, cool offices and other work perks now considered must-haves in tech workplaces today.

The Pandemic Bubble Bust

The parallels between the two bubbles are certainly uncanny, causing some to dub (opens in new tab) the present-day tech business woes the “Dot-Com Bust 2.0.”

But the robustness and maturity of today’s tech industry will likely prevent a crash of the magnitude experienced when the first dot-com bubble burst.

“What we saw in the [dot-com era] was some really comparable patterns, but the real difference is that everything [is now] many orders of magnitude larger,” said Margaret O’Mara, a historian of the high-tech economy at the University of Washington.

Venture capital invested in tech companies, for example, has quintupled in the last two decades, rising from roughly $60 billion in investments during the dot-com bubble to around $330 billion today (opens in new tab). And Nasdaq’s value has more than doubled, as well.

And even as companies announce rounds of layoffs and tech CEOs admit to pandemic-era overspending, experts say the losses accumulated by major firms is not likely to result in their disappearance (opens in new tab) altogether.

The effects of tech’s latest hits will hurt San Francisco the most. While the first dot-com bubble caused problems for the city’s commercial real estate sector, today’s combo of an empty downtown corridor and a shift to remote work is extremely concerning. But economists believe low unemployment rates and hiring levels earlier in the year indicate the relative stability in the SF job market compared with years ago.

Ultimately, market analysts and historians like O’Mara say that the ebb-and-flow of the market is “the Silicon Valley way,” fitting well within the oft-repeated narrative of boom-and-bust cycles in tech. And recent efforts to trim extraneous costs and spending may reflect more of a natural course correction following pandemic turmoil, rather than a massive overhaul of the industry.

“Tech is a cyclical business. Not every tech superstar is going to be a superstar forever,” O’Mara said. “In this industry, like any other, fundamentals of good management and business still apply. I think it’s good to not get too carried away when it’s a boom, and not too bummed out when it’s a bust.”

State of the City: November 2022

The Latest Indicators Impacting the Outlook for San Francisco

SF Stocks

Tough times continue for major SF firms as they grapple with slower growth. The latest market data shows share prices of several SF stocks up slightly this month after a rocky few months this spring.

Gas Prices

Gas prices peaked again in early October, but have since returned to August pricing at about $5 per gallon.

Unemployment

SF’s unemployment rate has returned to pre-pandemic levels, hovering around 2% since March. This provides cause for optimism despite layoffs reaching new heights.

Inflation

Inflation in the SF Bay Area largely follows national trends, though the region’s CPI remains below the U.S. average, with a roughly 1% (opens in new tab) increase in October.

Layoffs

The number of layoffs at SF companies in 2022 neared 20,000 this week, with news that Meta would ax 11,000 employees. Get the details on The Standard’s Layoff Tracker.

Venture Capital

The amount of venture capital invested in San Francisco continued to decline, dropping by more than 60% between September and October.

Property Crime

Property crime in SF started to decline in early October and remains below 2021 levels.

Violent Crime

Violent crime, on the other hand, rose steadily through the fall, with 243 incidents reported by the end of October.

FTX Crash

Cryptocurrency exchange FTX crashed in early November, wiping out nearly $2 billion in investor dollars in the process.

Cryptocurrency Prices

Crypto prices took a tumble in 2022—and San Francisco watched as Miami snatched the title of cryptocurrency capital during the pandemic.