San Francisco-based Blend Labs is conducting its fourth round of layoffs since April, the mortgage technology company said in a regulatory filing.

Blend, which builds software for mortgage applications and other banking functions, plans to eliminate 340 positions across the company, equivalent to around 28% of its domestic workforce. The eliminated positions represent annual compensation expenses of around $43 million, the filing stated.

The latest job cuts add to three headcount reductions over the past nine months as higher interest rates have pumped the brakes on the real estate market. Last year, the company announced job cuts in April, August and November totaling 430 eliminated positions.

Blend employed 2,276 people at the beginning of last year. The company said in its regulatory filing that the layoffs and prior cost-cutting initiatives are expected to save annual expenses of around $100 million and help the company become profitable.

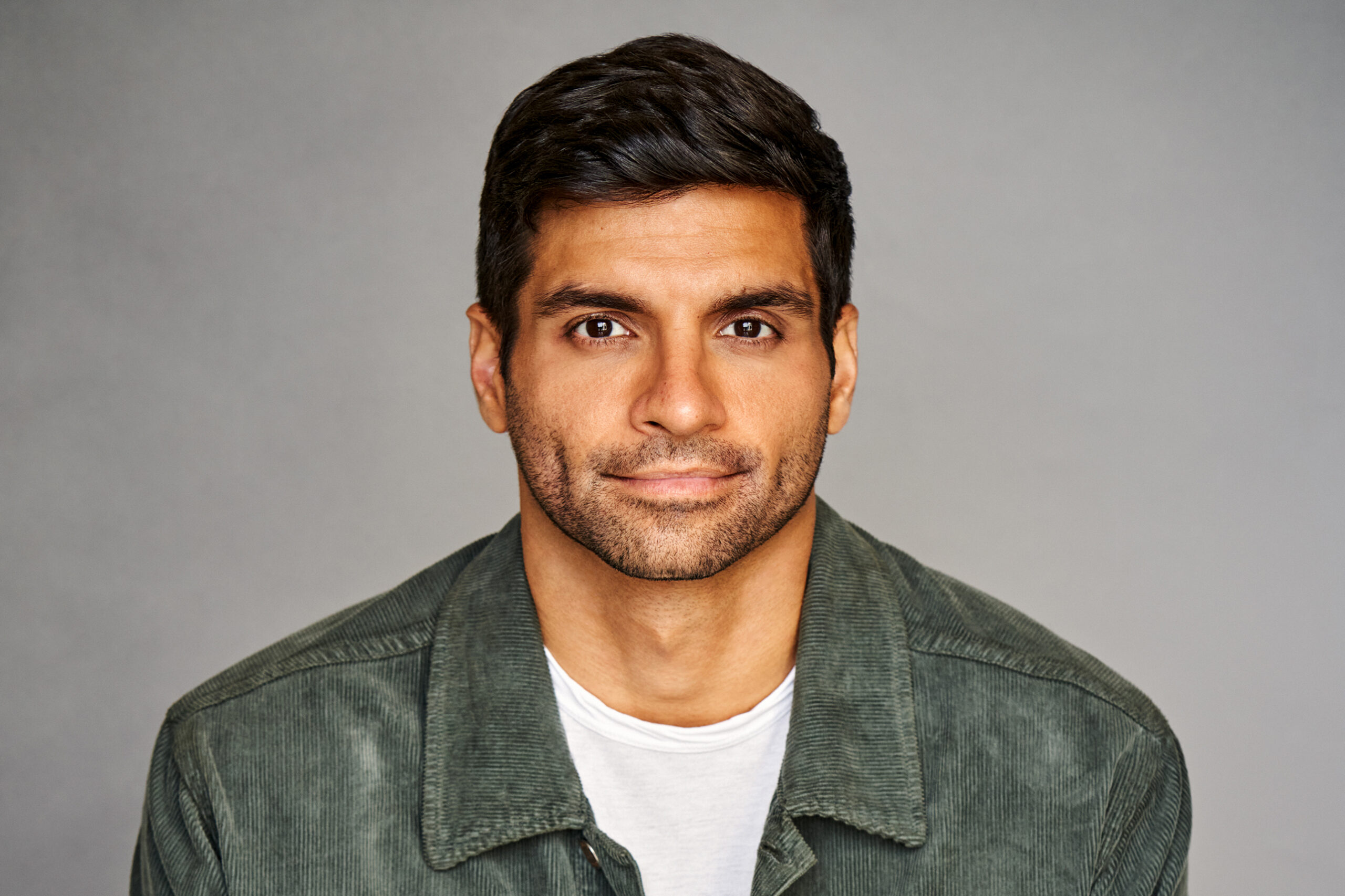

“We believe we will be in a much better position sooner to capitalize on a broader recovery once the interest rate and macro pictures clear,” Blend CEO Nima Ghamsari said on an investor call.

The real estate technology sector—which includes companies like Blend, Opendoor and Zillow—was buoyed by low interest rates and frenzied home buying activity during much of the pandemic. But that faucet was turned off as regulators looked to control runaway inflation through interest rate hikes.

Blend’s last quarterly earnings report in November reported a $134 million loss, falling well short of Wall Street projections.

The company went public in July 2021 during a white-hot real estate market. At the time, the company was valued at around $4 billion.

Since then, its stock price has dropped more than 90% from its public market debut. The company’s current market capitalization is hovering around $408 million.