What do Tom Brady, Shark Tank star Kevin O’Leary and the Ontario Teachers’ Pension Plan have in common?

They were all prominent shareholders of FTX, which collapsed in a spectacular fashion in recent months, rocking the larger crypto industry and potentially wiping out pricey stakes in the formerly flying company.

Bankruptcy filings lists major shareholders including Brady, who owned more than 1.1 million shares in the company. Brady’s ex-wife, the supermodel Gisele Bündchen owned around 686,000 shares in the company.

Citing capitalization tables provided by FTX, Forbes reported (opens in new tab) that at the company’s peak Brady and Bündchen’s stakes were worth $45 million and $25 million, respectively.

The onetime power couple (who have since split) were noteworthy boosters of FTX, which shelled out millions of dollars for marketing in the form of celebrity-laden commercials and expensive stadium sponsorships.

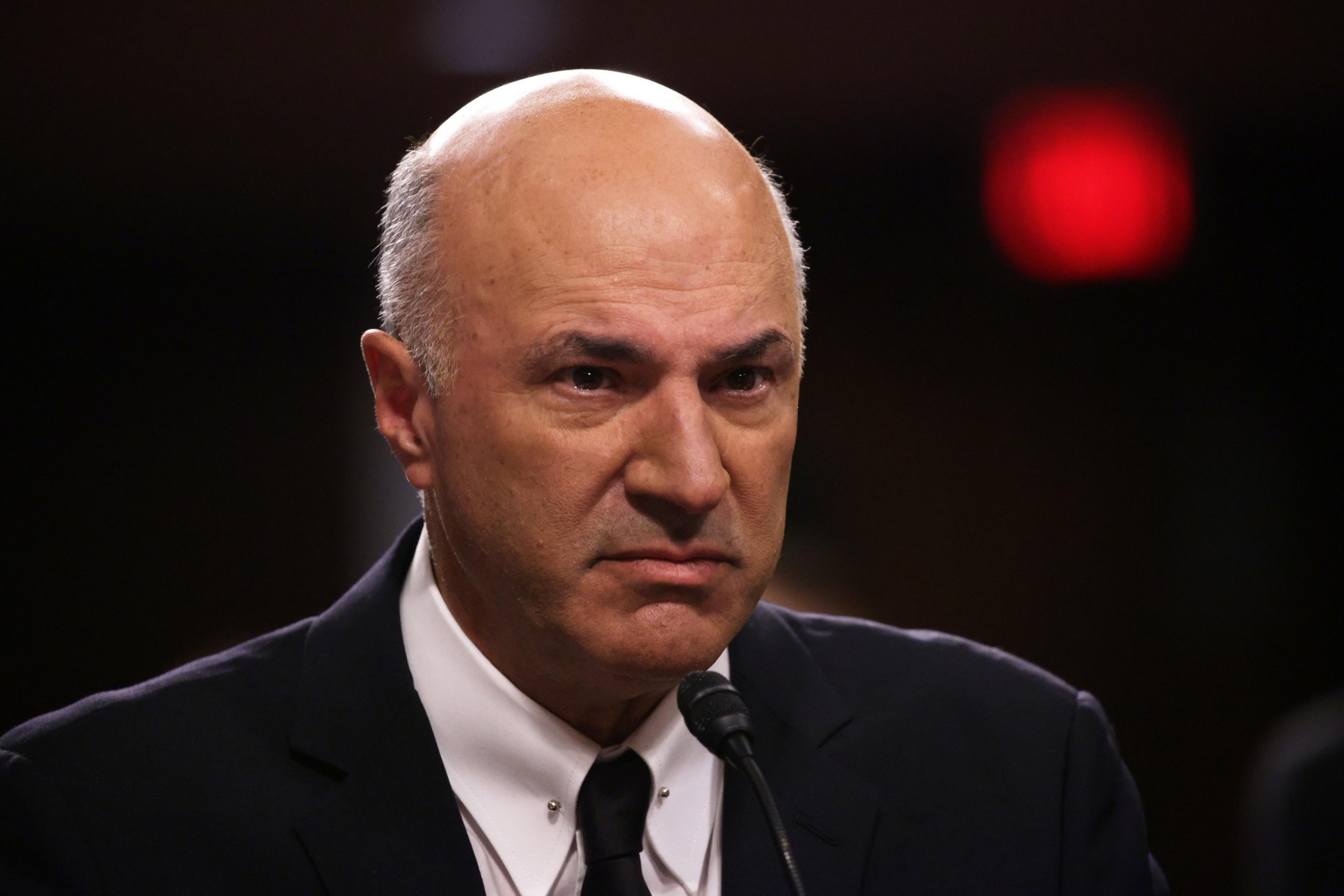

FTX advertisements included professional athletes like Miami Heat player Udonis Haslem and financial talking heads like O’Leary, both of whom held stakes in FTX.

Other potential losers include KPC Venture Capital LLC, a venture capital firm associated with New England Patriots owner Robert Kraft, as well as investment vehicles tied to professional baseball players Jason Hammel and Bobby Witt Jr. and rival cryptocurrency exchange Coinbase, which owned 929,989 shares in the firm.

Coinbase CEO Brian Armstrong appeared to point the finger at FTX in announcing layoffs of 950 employees yesterday, citing “unscrupulous actors” in the crypto industry triggering a “contagion.”

Other FTX shareholders listed in the bankruptcy filings are Erick Peyton, a producer who co-founded entertainment company Unanimous Media with Steph Curry; Nick Beckstead, the former head of the FTX Foundation; and a trust linked to Peter Thiel.

A number of notable institutional investors are also likely feeling the pain. Among the largest shareholders include Sequoia Capital (7.6 million shares), Paradigm (3.15 million shares) and SoftBank (3.07 million shares).

Those three groups helped to lead a $1 billion financing round in the company back in June 2021 that valued FTX at some $18 billion.

Just three months later, the company raised $420 million from investors that included the Ontario Teachers’ Pension Plan (2.79 million shares), Singapore-based Temasak (7.01 million shares) and Lightspeed Venture Partners (3.05 million shares) that boosted its valuation to $25 billion.

Last January, another $400 million funding round, pumped into the company by a number of repeat investors, kicked the crypto exchange’s valuation up again to $32 billion.

In a potential sign of the pain to come for the company’s backers, Sequoia marked down to $0 (opens in new tab) the value of its stake in the cryptocurrency exchange soon after news of the company’s alleged fraud broke.

Bankruptcy proceedings meant to help pay back FTX creditors continue, and the company recently reported that it has recovered $5 billion in cash and crypto assets. But the recovery of funds is complicated by the fact that selling crypto on the market could depress their value.

Federal regulators with the Commodity Futures Trading Commission have estimated that losses from the FTX collapse could stack up to $8 billion.

In bankruptcy cases, creditors are grouped in different classes and are paid out in order of priority. Equity shareholders like venture capital investors and the sports stars linked with FTX are at the bottom of the list—and in a case like this, are likely to be left in the lurch.

“At the end of the day, we’re not going to be able to recover all of the losses here,” said John J. Ray III, the executive leading FTX’s bankruptcy process, during Congressional testimony (opens in new tab) in December.

Sam Bankman-Fried, the once-revered crypto wunderkind, is currently in home detention (opens in new tab) in Palo Alto awaiting trial for his role in the alleged scheme that bankrupted the company.

Former associates, including former Alameda Trading CEO Caroline Ellison (opens in new tab) and former FTX CTO Gary Wang (opens in new tab), are cooperating with prosecutors and regulators and have agreed to plead guilty for their role in the alleged fraud. Bloomberg reported (opens in new tab) that another top company executive, Nishad Singh, who previously led engineering at FTX, is in talks with prosecutors on a potential plea deal.