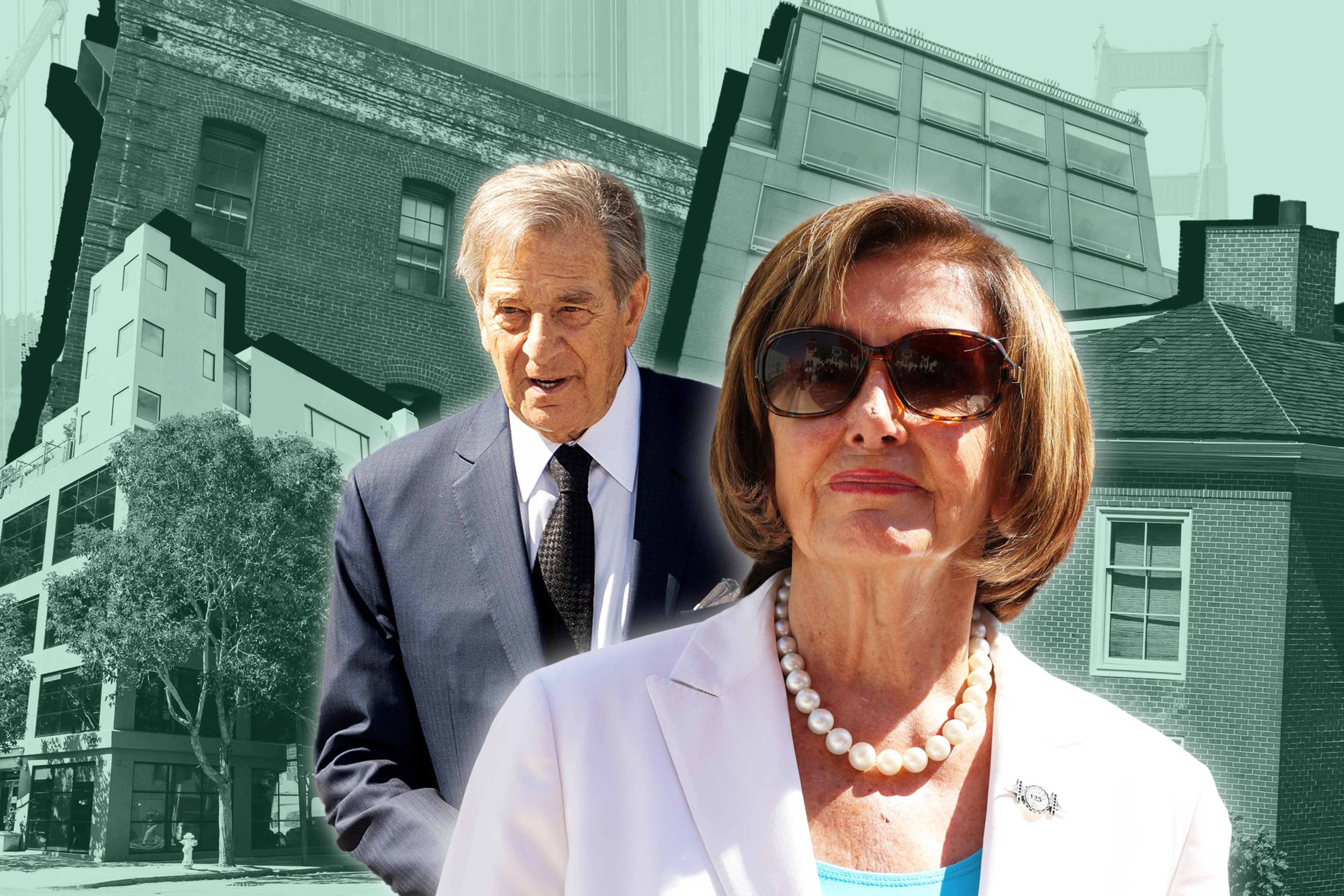

Speaker Emerita Nancy Pelosi doesn’t technically own stocks — according to a spokesperson — but that hasn’t stopped people from tracking her husband’s trades with funds formed specifically (opens in new tab) to mirror well-timed sales and purchases.

But a recent financial disclosure (opens in new tab) has revealed a lesser-known part of the portfolio of Pelosi and her husband, Paul: San Francisco commercial real estate. And judging by their luck, these recent deals may be an indicator that the city’s beleaguered market is poised for a turnaround.

A filing certified Sept. 11 by Pelosi showed that her spouse invested between $250,000 and $500,000 in an entity acquiring and managing a commercial office property at 631 Howard St. in SoMa. The five-story Class B office building was purchased for $36.4 million by a partnership between businessman Greg Flynn and San Francisco real estate firm Ellis Partners.

Last year, Paul Pelosi appeared to have invested in another of Flynn’s local real estate projects. According to the congresswoman’s last annual financial disclosure (opens in new tab), her husband invested between $500,000 and $1 million in an LLC that is “acquiring and restoring a luxury hotel” in San Francisco.

Flynn and Highgate, a hospitality management company, purchased the historic 135-room Huntington Hotel the same month Pelosi’s investment was reported. The parties are in the process of renovating the shuttered Nob Hill establishment, with plans to reopen it in 2025.

A spokesperson for Flynn declined to comment.

“Speaker Pelosi does not own any stocks, and she has no prior knowledge or subsequent involvement in any transactions,” said Ian Krager, a spokesman for Pelosi.

The Pelosis’ stakes in the properties, the latest in a tranche of commercial real estate holdings in San Francisco, represent an investment by a civic leader during a severe market downturn.

Wealthy individuals like Pelosi, whose net worth has been estimated in the nine figures (opens in new tab), have been the engine of recent transactions in San Francisco as traditional lenders have pulled back from financing commercial real estate deals.

Under her disclosures, the assets are listed as owned by Paul Pelosi. A spokesperson for the congresswoman declined to comment.

“Truth is, the investment markets are still out on San Francisco properties,” said a real estate broker with knowledge of Flynn and Pelosi. “Normally, [Flynn] would have gone in with a capital partner and a bank. But these days, you cobble together what you can. The one percent [with money] can make these sorts of moves right now.”

Paul Pelosi — who was brutally assaulted in his Pacific Heights home by an intruder in 2022 — is known in business circles for his real estate investments, an ill-fated attempt to launch a professional football league (opens in new tab), and, more recently, well-timed trades of prominent tech stocks such as Nvidia and Microsoft.

According to his wife’s 2023 financial disclosure, Paul Pelosi’s San Francisco commercial real estate holdings also include a low-slung commercial property at 25 Point Lobos, just south of the Presidio, that houses a Walgreens pharmacy. The property is assessed at $5.8 million, and Pelosi reported that it generates between $100,000 and $1 million annually in rent.

Other San Francisco properties in which the Pelosis hold stakes include:

Gallery of 4 photos

the slideshow

The Pelosis have a range of other holdings outside San Francisco, including a Napa Valley vineyard, the Auberge du Soleil luxury resort in Rutherford, and an undeveloped housing tract in Sacramento.

While real estate remains a key part of the couple’s portfolio, consortiums looking to enter the market might have other options soon. On Wednesday, the Federal Reserve cut interest rates (opens in new tab) for the first time in more than four years, by half a percentage point, which may generate investment activity.